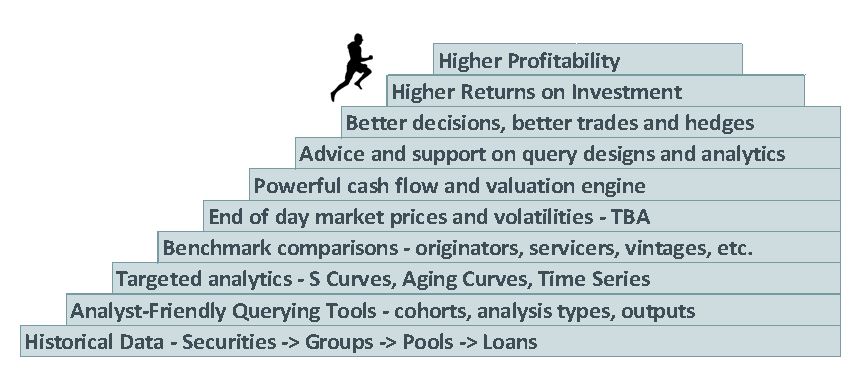

The Berkshire Group maintains a powerful suite of proprietary data, tools, and processes designed for our clients’ success. The tools fall into three general categories:

• Performance Analysis and Prediction

– AssetAssayer ™ Predictive Modeling and Asset Valuation – Pricing, Loss Reserves, and Reserve Analysis

– BGVAL™ Analytics Portal – Agency and Non-Agency Data and Analytics

– CDB.Deep.Dive™ Mortgage and Economic Performance Analytics

• Risk Assessment

Matri-X™ – New Loan Origination Reviews –Re-Underwriting, Pre-Closing and Post-Closing TRID audits, Forensic Loan File Reviews

–CALLforward ™ – Bank Modeling, Stress Testing and Analytics

• Workflow Management

–CaseKnit – Big Data Litigation – Interactive Findings Review / Workflow Management

–ProCapture™ – Securitization Document Comparative Analysis

–CORE™ – Credit Operations Risk Evaluation (Process, Compliance, CFPB Audit)

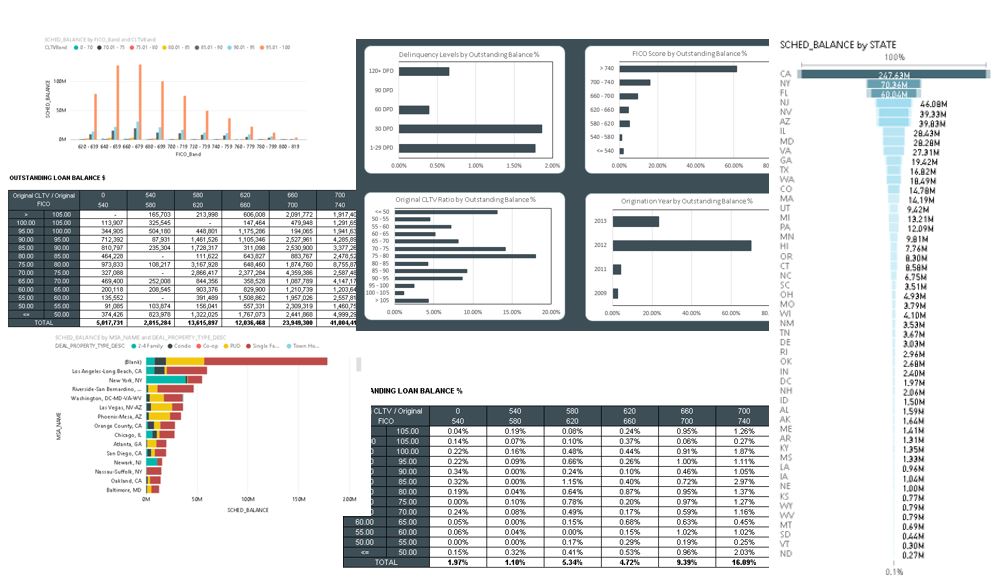

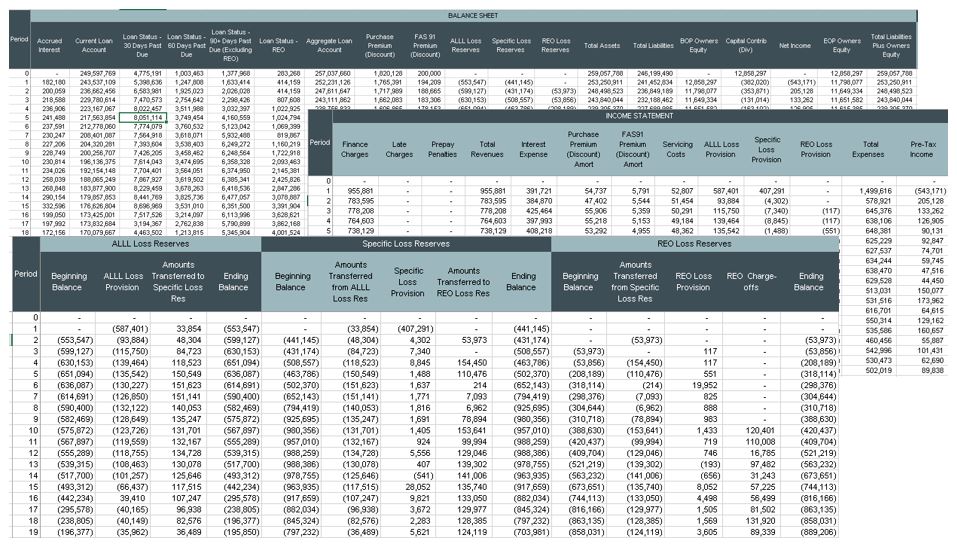

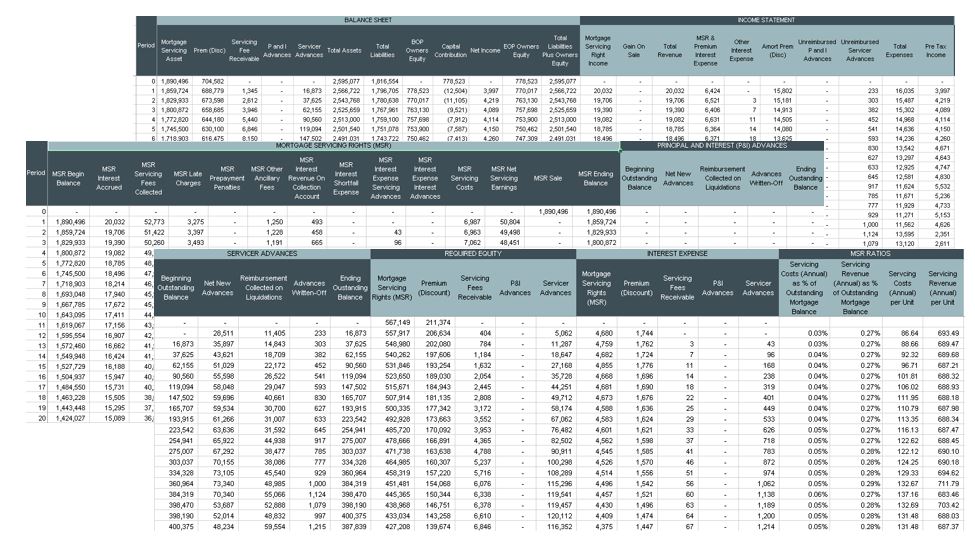

AssetAssayer ™ and Power Business Intelligence – Pre-Processing Reports, Charts, and Graphs

AssetAssayer ™ – Detailed and Summary Outputs

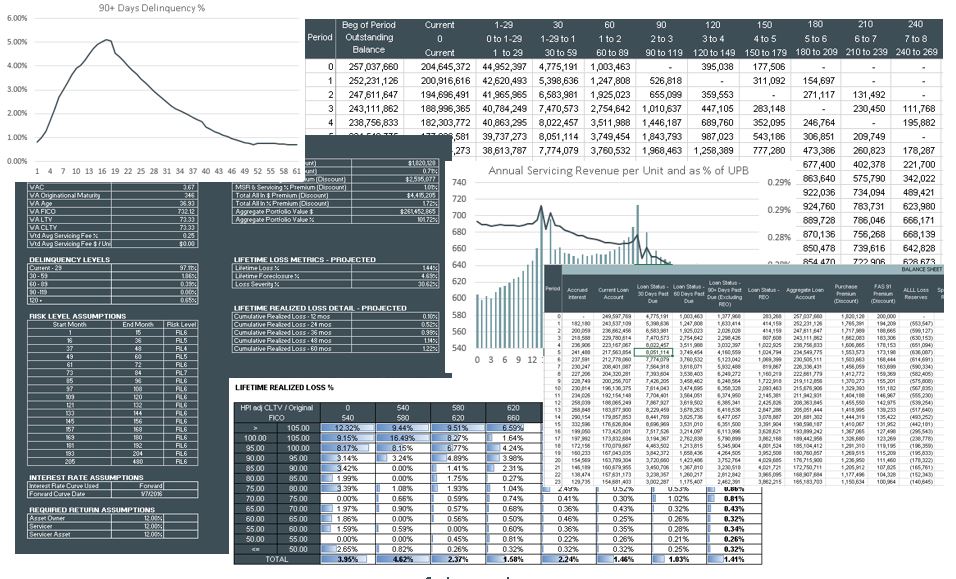

AssetAssayer ™ – Loan Pricing and Loss Reserve Analysis

AssetAssayer ™ – MSR Pricing and Analysis

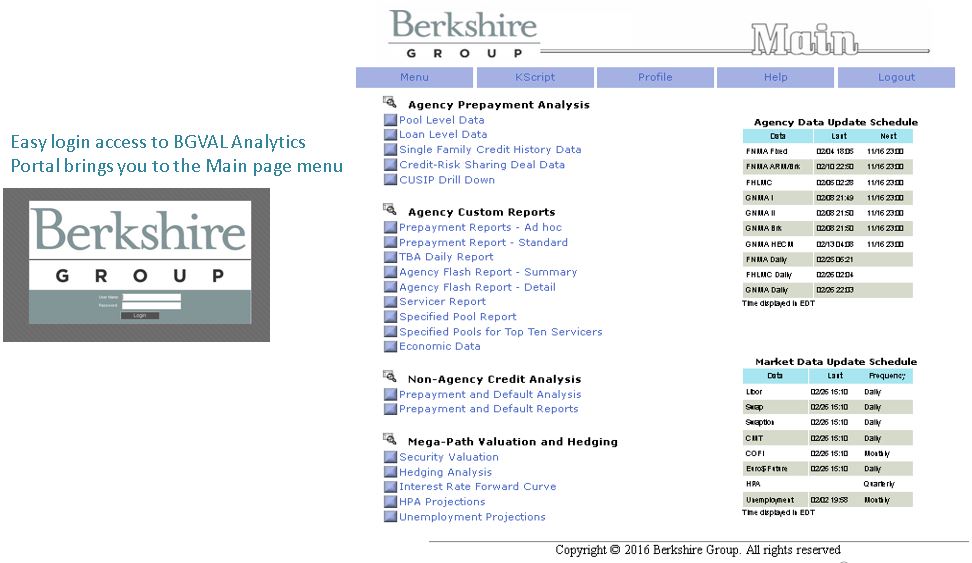

BGVAL™ Analytics Portal

Agency and Non-Agency Data Queries , Valuation, Reports

BGVAL™ Analytics Portal

Agency and Non-Agency Data, Analytics, and Valuation

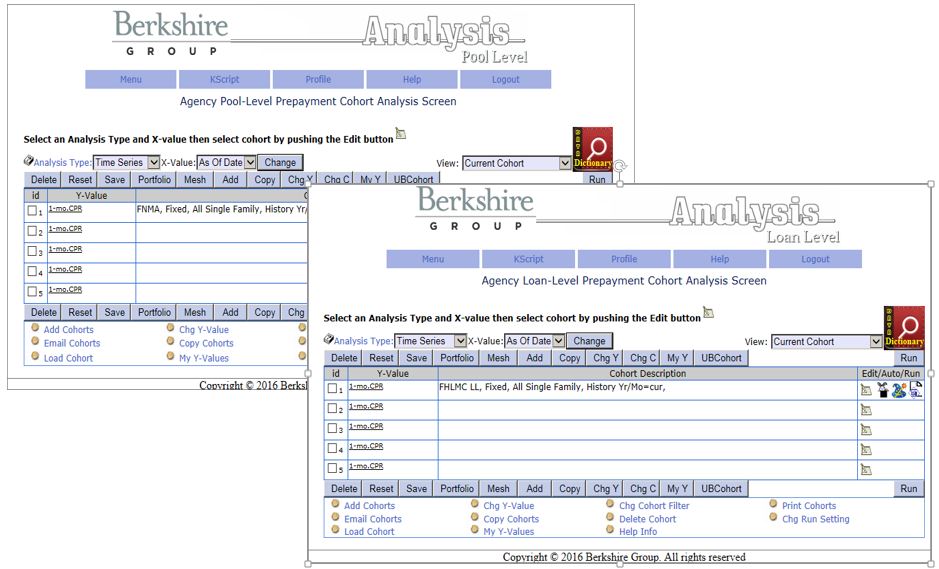

BGVAL™ Analytics Portal

Agency Pool and Loan Level Data and Analytics

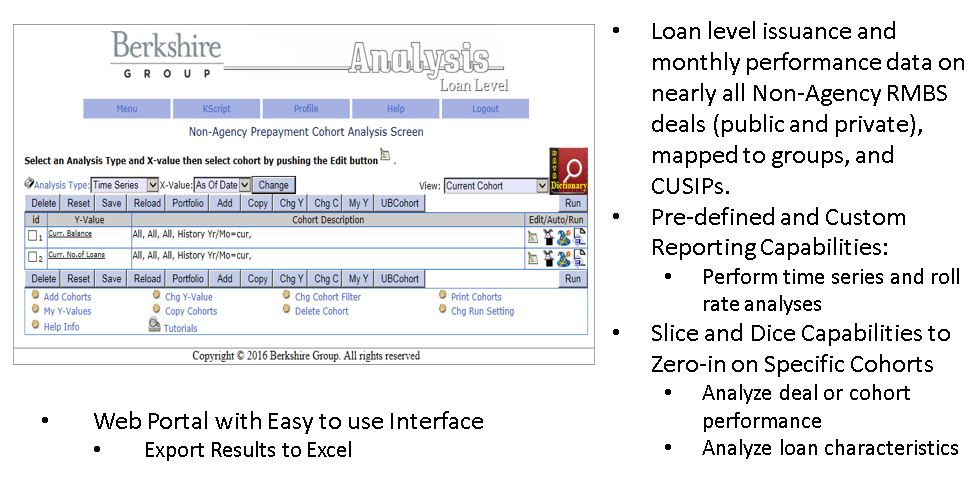

BGVAL™ Analytics Portal

Non-Agency Loan Level Data and Analytics

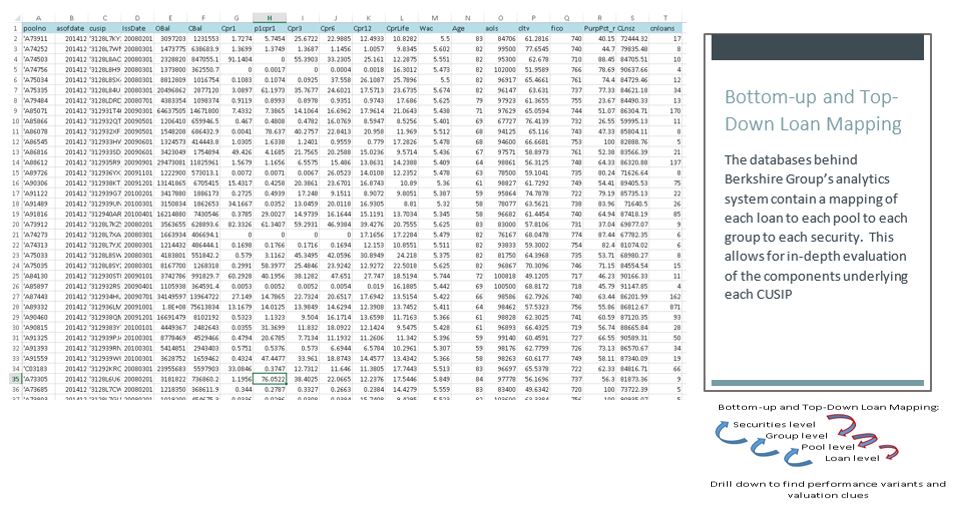

BGVAL™ Analytics Portal

Loans Mapped to Pools, Groups, Deals, CUSIPs

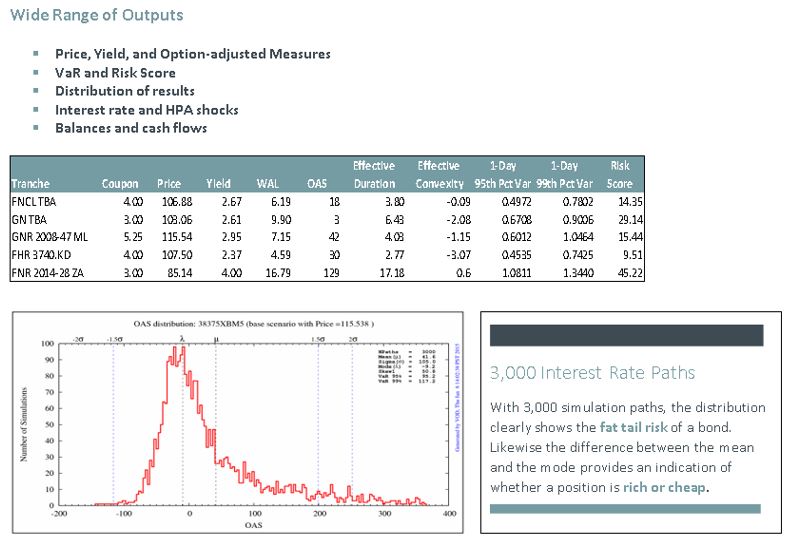

BGVAL™ Analytics Portal

Multipath Analysis of Pools and CUSIPs

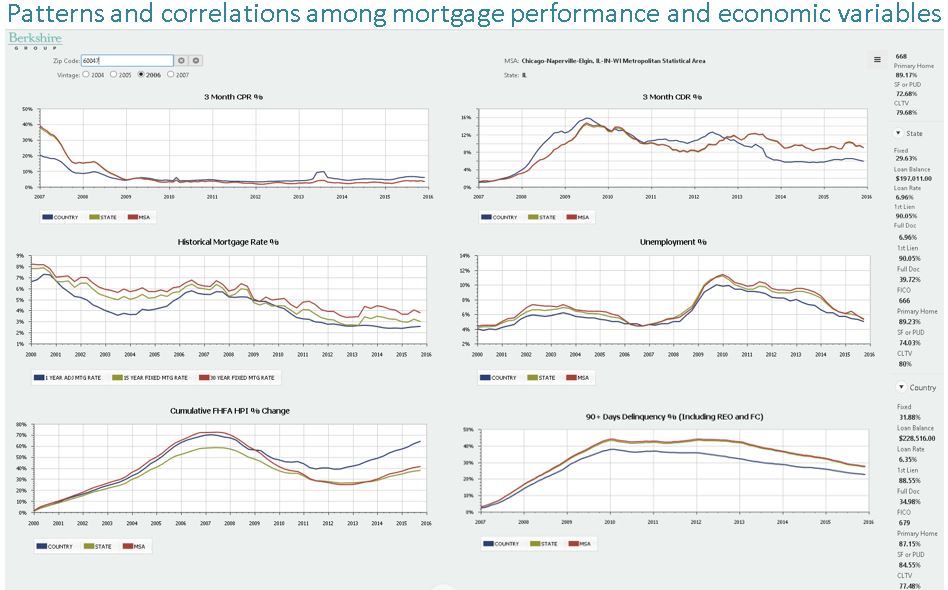

(Collateral Data Base) CDB.Deep.Dive™

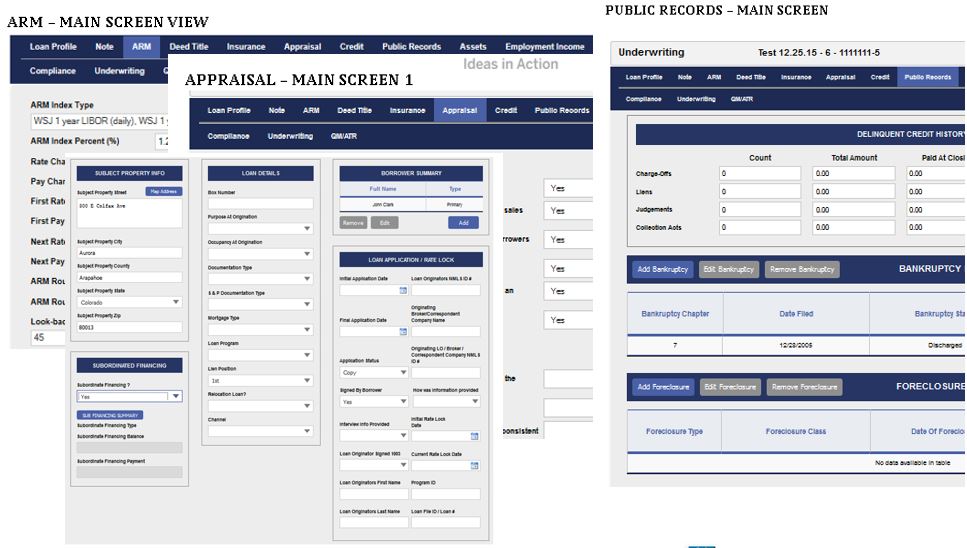

Matri-X™

Loan Re-underwriting and Repurchase Claims Response System

- Feature-rich data gathering system to collect and organize loan information for analysis

- Web-based and designed to be user-friendly

- Provide a logical workflow sequence for the underwriters • •

Supports:

- New loan origination re-underwriting

- TRID pre-consummation and post-consummation reviews

- Forensic re-underwriting –Repurchase claims review and response

Matri-X™

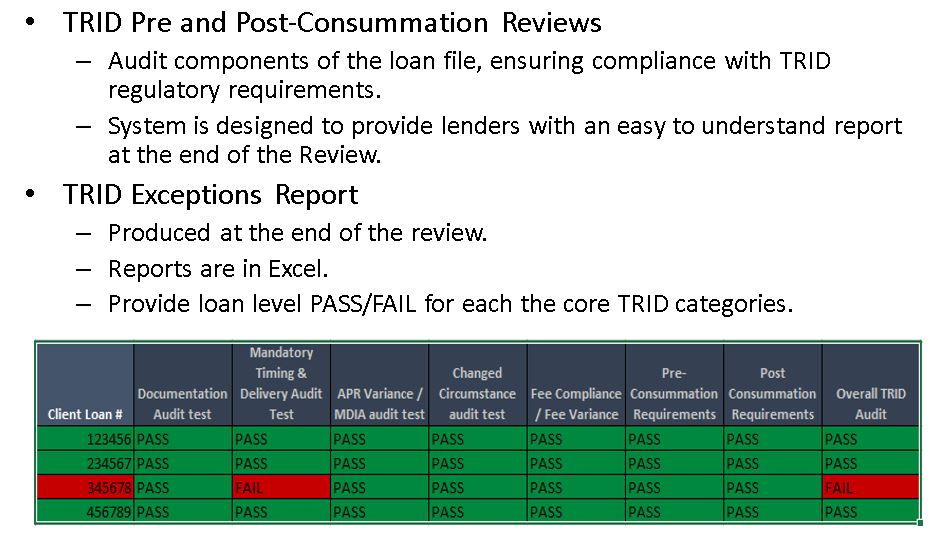

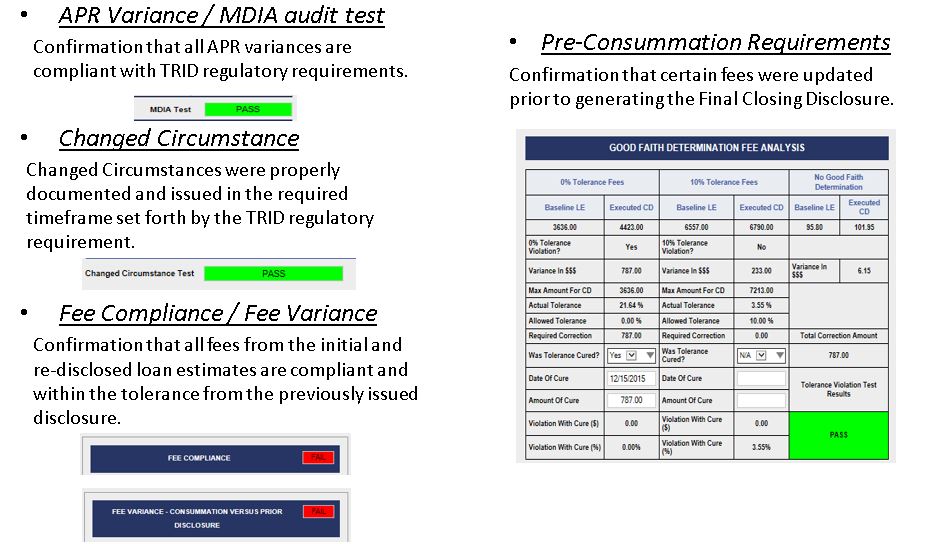

TILA-RESPA Integrated Disclosure (TRID) Solutions

Matri-X™

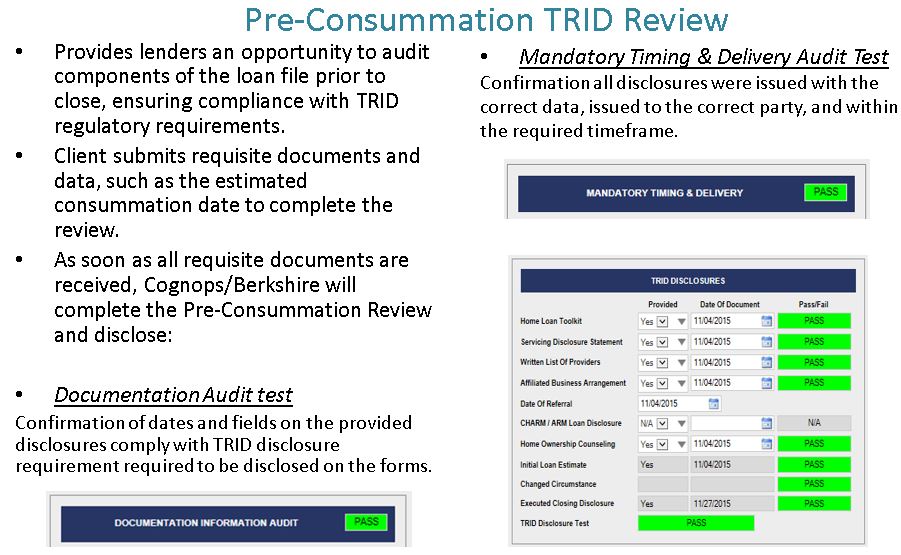

Pre-Consummation TRID Review

Matri-X™

Pre-Consummation TRID Review (Continued)

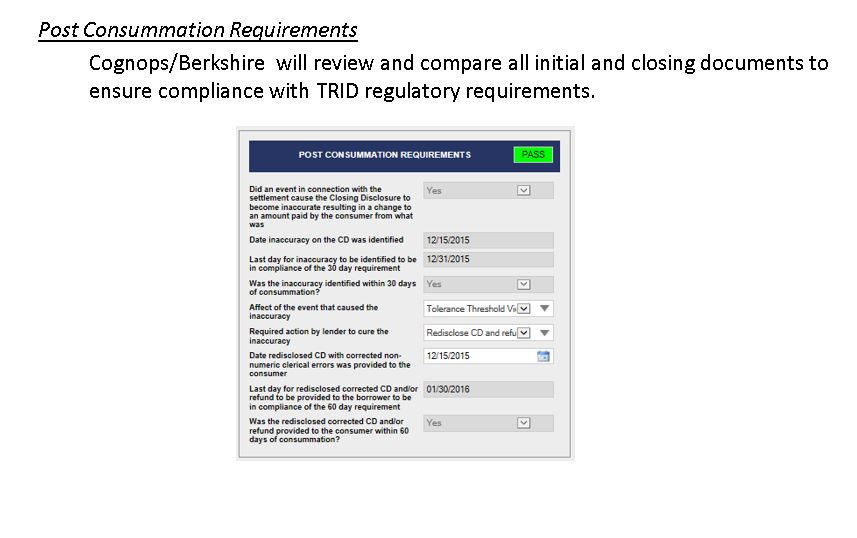

Matri-X™

Post-Consummation TRID Review

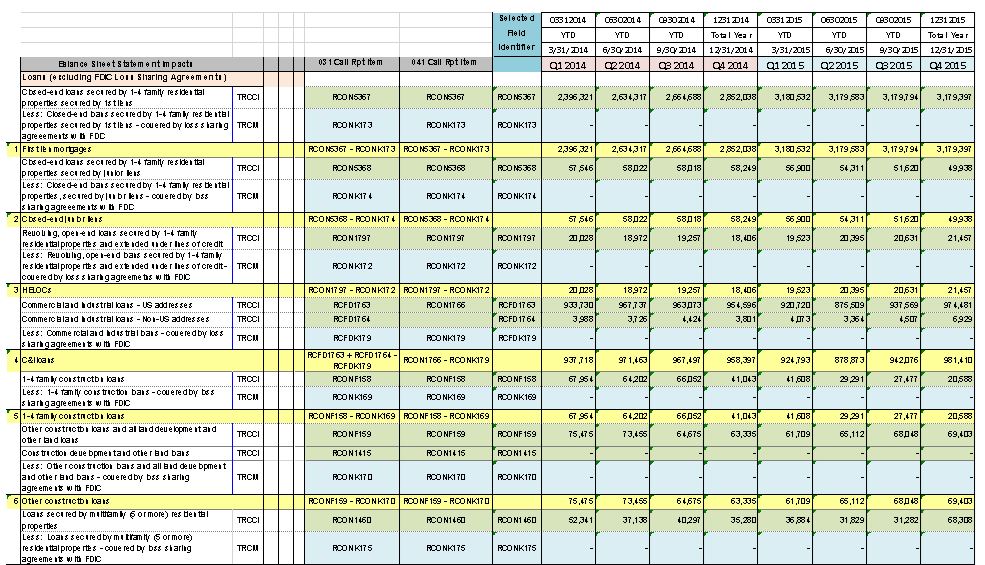

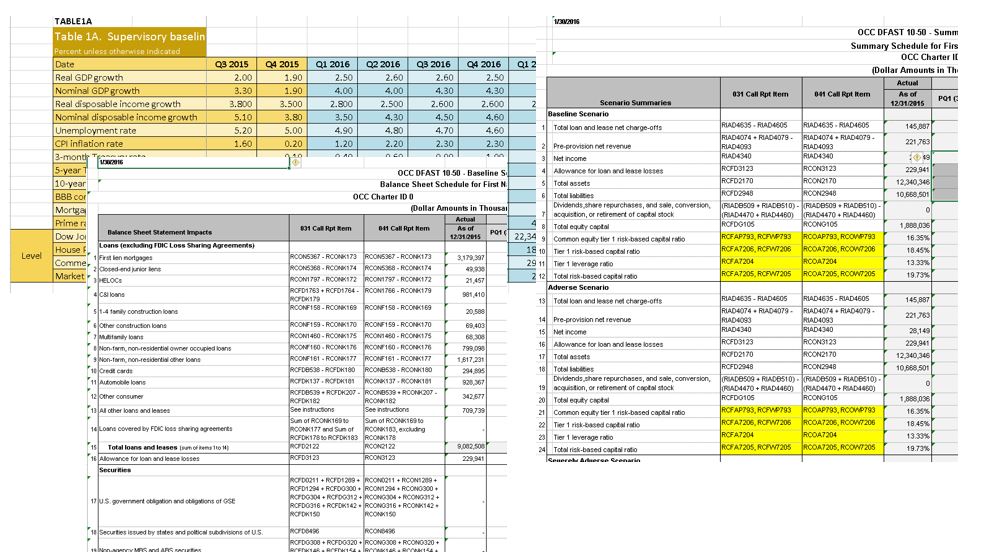

CALLforward™

Bank Modeling, Stress Testing and Analytics

CALLforward™

Bank Modeling, Stress Testing and Analytics (Cont.)

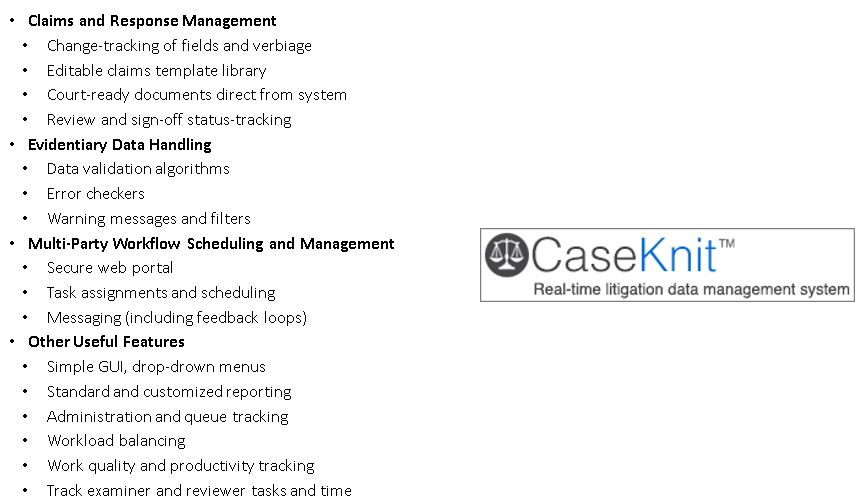

CaseKnit™

Big Data Litigation Support-Interactive Findings Review & Workflow Management System

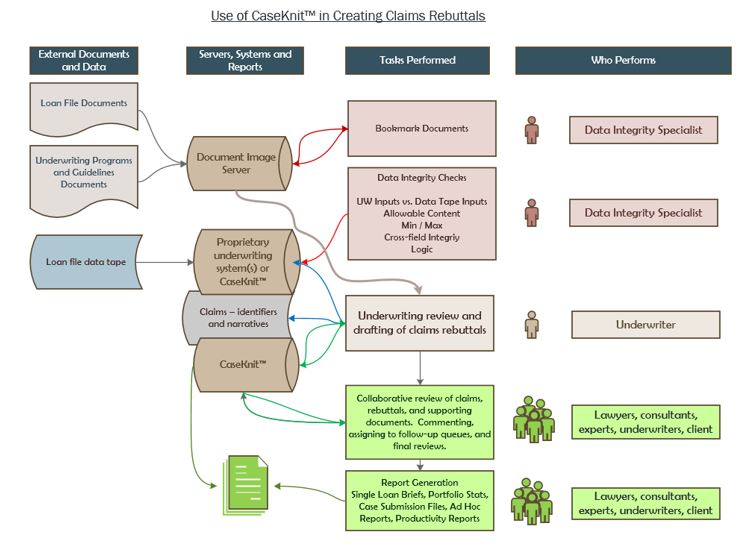

CaseKnit™

Work Flow Chart

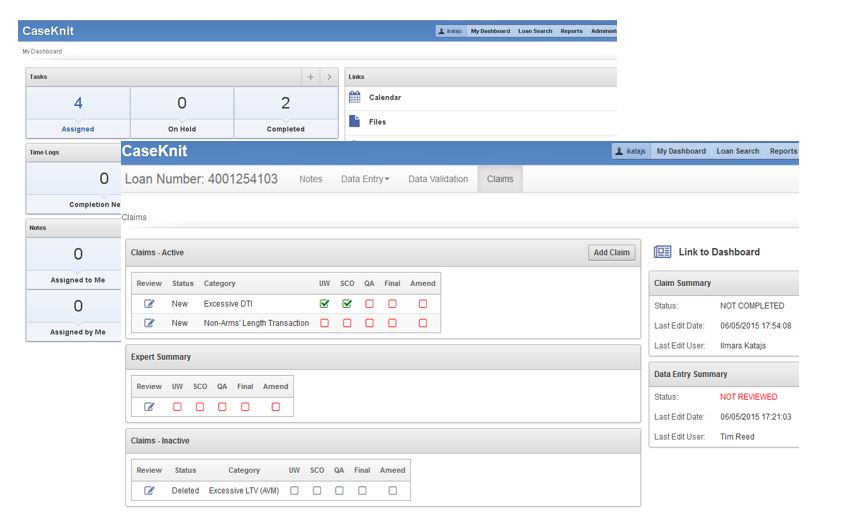

CaseKnit™

Workflow Management and Status Screens

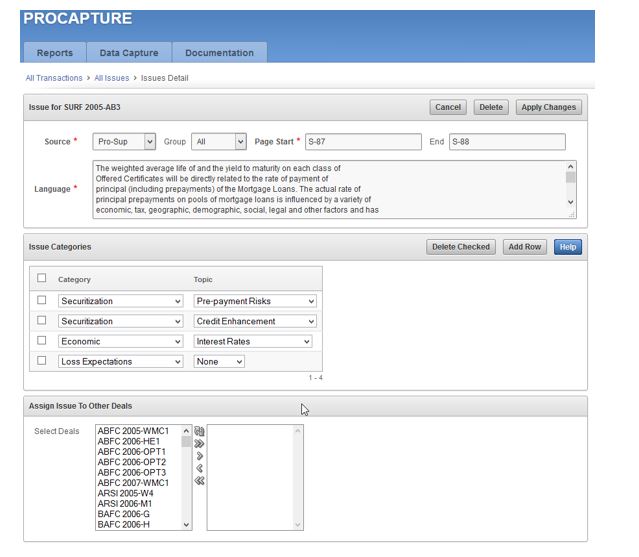

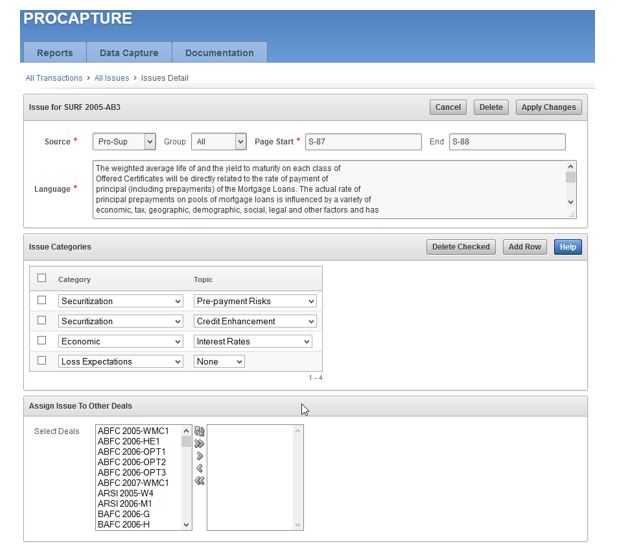

ProCapture™

Securitization Document Comparison and Review System

ProCapture™

Catalog and Organize, Compare Language in Drafts and Among Deals