Company Overview:

Founded in 1998, The Berkshire Group LP is a management-consulting firm that provides predictive modeling, asset valuation, data analysis, transaction support, and due diligence services to the financial services industry. The Company offers these services through two affiliated entities, including itself and Berkshire Advisors LLC (collectively, “Berkshire” or the “Company”)[1].

Berkshire focuses on four primary areas of service:

- Predictive modeling of the expected monthly performance of residential and commercial mortgage loans, consumer secured and unsecured loans, and related assets[2], as well as valuing the loans and related assets;

- Transaction support and management for the purchase and sale of residential and commercial mortgage loans, consumer secured and unsecured loans, mortgage servicing rights, consumer loan servicing rights, mortgage-backed and asset-backed securities, and related assets;

- Maintaining and hosting of a massive collateral database (“CDB”) tracking monthly performance on over 260 million active and resolved residential mortgage loans[3];

- Loan file underwriting and regulatory compliance reviews.

The Company provides a substantial menu of services tied to these primary service areas. The Company uses specialized consultants, analysts, database managers, underwriters, independent contractors and propriety systems to perform its services.

Berkshire has developed, maintains, and uses proprietary models for various predictive modeling applications. These applications include projecting prepayments, delinquencies and losses, valuing and pricing assets, performing capital and loss reserve adequacy analysis, and performing loss causation analysis.

Loan Database

As a basis for developing and maintaining its predictive models and the assumptions that drive the models, Berkshire uses monthly performance data in its CDB to do statistical analysis, identifying factors most highly correlated with different patterns of borrower behavior under varying economic stress scenarios. In addition, the Company conducts extensive surveillance of loans it has evaluated for clients, back-testing actual performance against predicted performance of the pools.

In addition to the loan data in the CDB, Berkshire tracks various macroeconomic factors correlated with or directly impacting borrower behavior and the performance and value of loans. For instance, Berkshire tracks historic home pricing indices down to zip code level in many markets. We also collect and track data on foreclosure and REO processing timelines and costs by location. We track interest rates, home affordability, employment and other relevant metrics. Combined, this data helps us to better project balances, cash flows, delinquencies and losses of individual loans and portfolios based on the specific attributes of borrowers, loan products, properties, and other risk elements inherent in each loan.

Berkshire Resources

For its due diligence services, Berkshire uses a combination of internal consultants, independent contractors, and dedicated due diligence, appraisal, credit and compliance firms to complete the review of the loans in each portfolio. The Company uses a secure, proprietary system for recording, evaluating, and reporting due diligence results, and for feeding them into Berkshire’s predictive model for post-due diligence re-evaluation of the loans. Using its combined teams of professionals and advanced system tools, Berkshire is able to cost-effectively review the files and properties underlying loans in support of our evaluation efforts.

Berkshire’s client base includes banks, savings banks, REITs, hedge funds, private equity firms, mortgage companies, trustees, bond insurers, GSEs, primary mortgage insurers, attorneys, and other parties requiring risk evaluations, pricing, loss projections, loss reserve assessments, litigation support and other services.

Company senior managers average over 30 years of residential mortgage lending, underwriting/ compliance, servicing, pricing, and capital markets experience. Its consultants come from diverse mortgage-related backgrounds, with years of experience working within investment banks, mortgage companies, banks, investors, credit insurers, and accounting firms.

Berkshire’s Products and Services Overview

Predictive Analytics

Berkshire maintains a proprietary model (the “Berkshire Model” or the “Model”), which it uses for loan evaluation work, including risk-adjusted projections of loan balances, cash flows, delinquencies, losses and the adequacy of loss reserves and regulatory capital. The Model is used to evaluate mortgage loans, consumer loans, MSRs, ABS, MBS and related derivative instruments. The Berkshire team actively maintains assumptions supporting performance curves, costs, foreclosure and REO timelines and costs, interest rates, spreads, bond structures and other factors crucial to pricing.

The Company projects performance with the information it has available, considering relative risks owing to borrower, product, and property characteristics, and an eye towards economic, regulatory, competitive and company-specific factors. Berkshire analysts rely heavily on the data and information provided by the client, often with only a limited opportunity to verify it.

The Berkshire Model

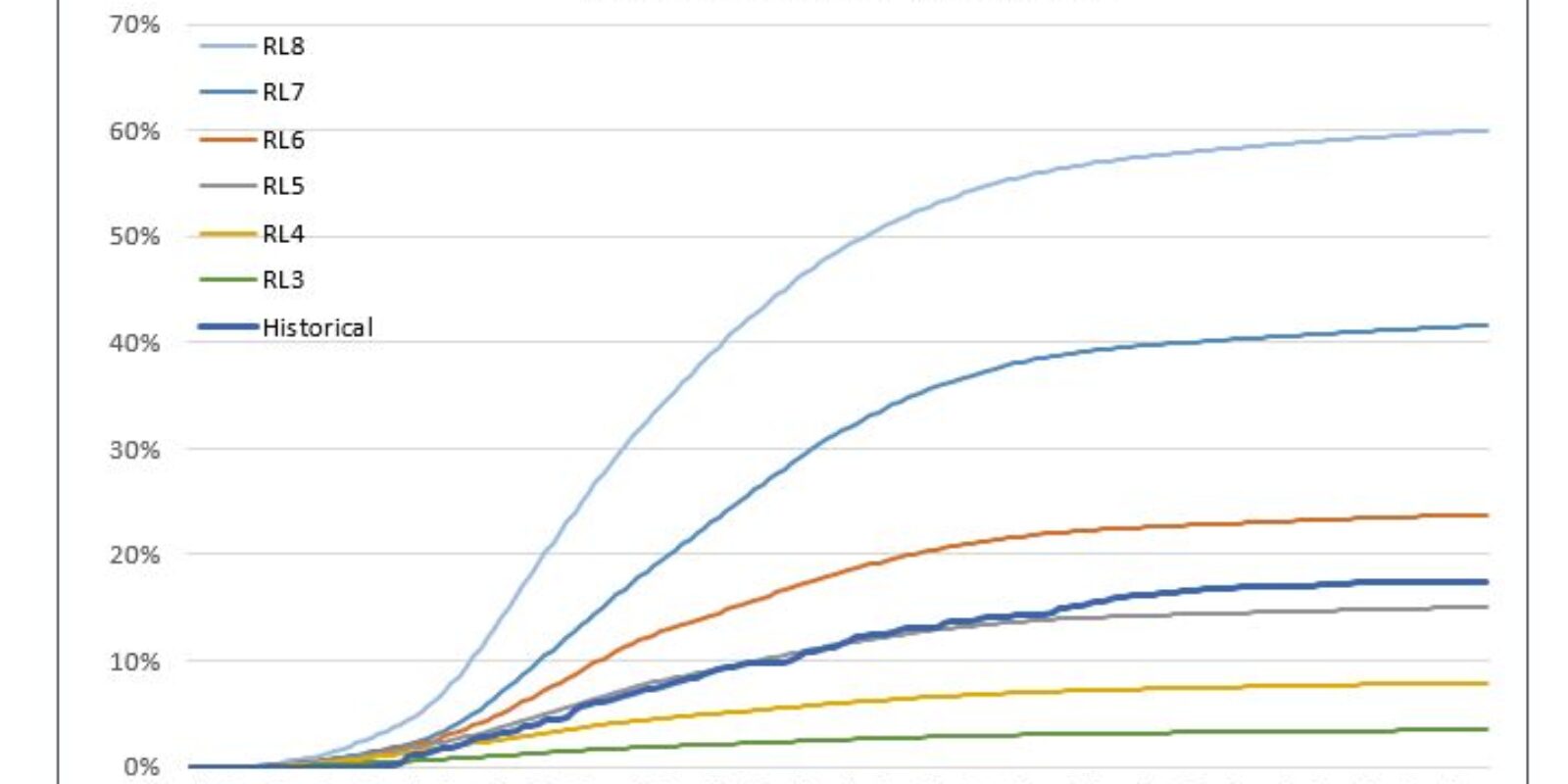

The Berkshire Model provides granular risk-adjusted performance evaluation and pricing at the loan level. The Model projects an individual prepayment curve, default curve, and loss severity curve for each loan, which serves as the basis for projecting expected cash flows.

The Model starts with baseline performance curves defined for “Benchmark Loans” (see next section below), developed from proprietary and industry data sources. It then risk-adjusts the curves based on the loan’s individual borrower, property, and loan characteristics. The risk adjustment factors vary depending on assumed economic stress environments. Berkshire has developed and tested the risk adjustment factors over the last decade across multiple economic stress environments. The risk-adjusted curves are then used to project collateral balances, and cash flows and losses over the life of each loan.

Default (involuntary prepayment) and voluntary prepayment curves are risk-adjusted and projected separately but work interactively within the Model. For example, borrowers can become delinquent and go into foreclosure for many reasons, such as the occurrence of a “life event” (injury, illness, divorce, etc.). The more delinquent a loan becomes, history shows it is less likely the borrower will voluntarily prepay the loan. Conversely, the more rapidly a loan voluntarily pays down, the less time available for the borrower to experience a life event and default. Risk adjustment factors that cause rapid prepayments, thus interactively lead to lower overall defaults. The interaction of the two forces is captured in the interaction of the default and prepayment curves.

The risk-adjusted default curve for each loan is mathematically converted into delinquency roll rates. This allows the Model to project the expected pattern and magnitude of delinquency, from 1-29 days delinquent all the way through liquidation. Timing of liquidation for each loan is dependent on the risk-adjusted foreclosure, redemption period, and REO sales timeline for the geographic area in which the property is located. Costs of foreclosure and liquidation are also geographically dependent. This approach allows Berkshire to better assess the timing and magnitude of servicing costs and the interest costs of making servicing advances.

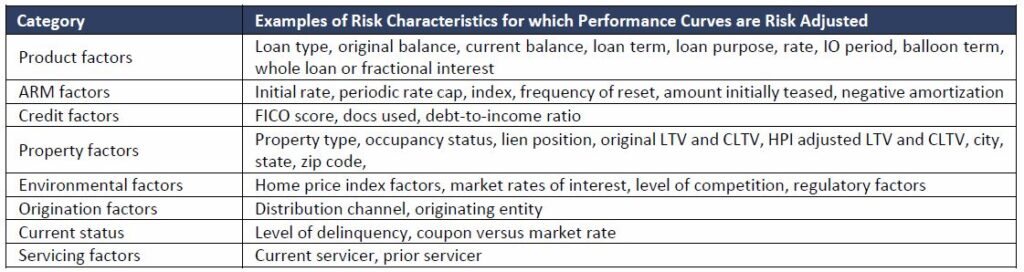

Benchmark Loans

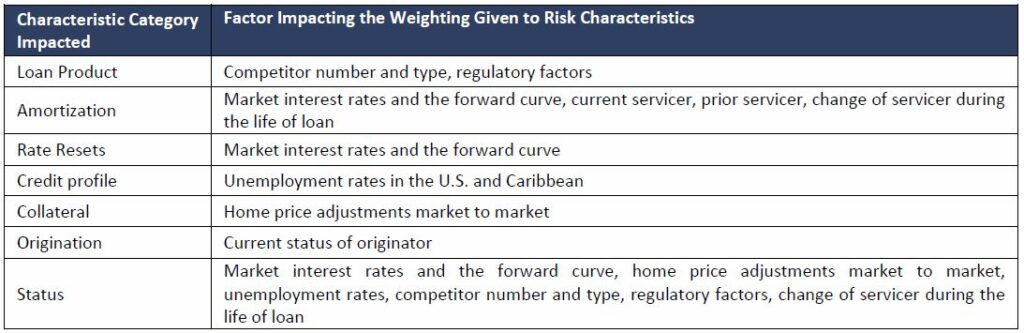

Adjusting for risk presumes that a Benchmark Loan with a defined risk profile exists against which adjustments can be measured. The risk profile of the Benchmark Loan, and all loans, is defined across a spectrum of risk characteristics, including those in the following table.

By examining historical performance patterns and current trends of loans possessing the Benchmark Loan risk profile, benchmark performance patterns are determined.

Examples of performance patterns observed include:

- Prepayment curves;

- Default curves;

- Foreclosure and REO timelines and costs, by state; and

- Property value changes, by state.

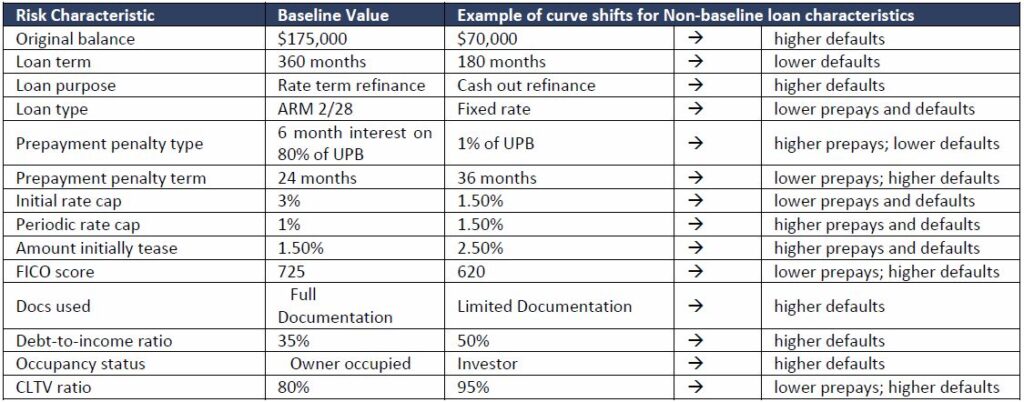

Adjustments to Benchmark Loan Performance Patterns

Adjustments to benchmark performance patterns are identified by further examination of historical performance patterns and current trends of assets whose risk profiles differ from that of the Benchmark Loan, and are quantified into Performance Adjustment Factors (PAFs). PAFs may be absolute (parallel shift over time), relative (percentage shift over time), or some combination of both. In the model, Berkshire populates a “Risk Adjustments” assumption table with PAFs derived from historical data and observations of current trends, and based on professional experience. Using the PAFs, the model automatically adjusts the Benchmark Performance Patterns for each loan according to its unique risk profile. Some risk characteristics will result in favorable performance pattern shifts, some unfavorable. Off-setting risks are accounted for in the performance pattern shifting process.

The Model validates risk characteristics each period. Non-static characteristics, such as remaining prepayment penalty term, loan age, and coupon versus market rates, are validated for each period, and performance patterns adjusted accordingly. Based on home price index (“HPI”) projections, property values are dynamically updated, which in turn impact expected prepayments, defaults and severity of losses. This feature enables us to run multiple interest rates and stress scenarios and get automatic performance pattern adjustments.

The Model captures prepayment spikes when prepayment penalties end, no matter how old the loan is when evaluated. The Model looks at the loan age and picks up prepayment and default curves at the appropriate point. Existing delinquency is captured and taken into account.

The table below provides examples of directional adjustments to curves based on characteristics different from baseline mortgage loan characteristics.

Aside from assumptions related to the characteristics of borrowers’ credit, loan products, and properties, the model draws on assumptions input regarding exogenous factors impacting loan performance. Some are discussed below.

External Factors

The risk profile is further defined by external factors, as they magnify or reduce the weighting given to each characteristic. Changes in external factors are expressed in “stress scenarios”. Some of the relevant external factors impacting characteristic weightings are in the following table.

Economic Stress Scenarios

Berkshire performs its analyses assuming one or more levels of stress exist in the economy. Stress takes the form of varying levels of unemployment, foreclosure rates, median home price declines and other factors. The level of stress assumed impacts many PAFs and other assumptions discussed above, causing a multiplier effect of varying degrees depending on the stress scenario or combination of stress scenarios assumed.

Dependent on client specific needs, Berkshire will run multiple stress scenarios. Berkshire will start with a Base Case stress scenario, and for example, adjust for a Higher Prepayment (HP) case, Lower Servicing Cost, Higher Servicing Cost case, etc. In the Base Case, the prepayment curve for each loan is generated by Berkshire’s Model based on selected economic stress level, the borrower, loan, and property characteristics. In the HP case, we assume that economic events lead to higher prepayment speeds.

Market Interest Rates

Interest rate projections are based on the forward curves derived from market rates as of the date of each file review.

Discount Rates

The discount rate is applied based on the economic environment at the time of the valuation to achieve the market value.

HPI – past and future

Berkshire’s analysis may include obtaining updated broker price opinions (“BPOs”) on some of the properties underlying loans reviewed. Often Berkshire just rolls home values forward from date of origination to the “as-of” date of the file using home price index (“HPI”) factors for each market area, using these HPI adjusted property values as a starting point of evaluation of each loan.

The Model uses going-forward HPI factors by geographic location. Base HPI assumptions come from subscription and proprietary databases. Berkshire further risk-adjusts base HPI assumptions according to each economic stress scenario run.

The historic HPI roll forward and going-forward HPI factors have a significant impact on expected loan performance and ultimate loss severity if a home has to be liquidated. The HPI-adjusted values affect the magnitude of proceeds realized at time of liquidation and thereby the loss severity. It also affects the default and prepayment curves used in our evaluations.

Foreclosure and REO Timelines and Costs

Based on discussions with client personnel and the review of a client’s servicing operations, Berkshire makes assumptions by geographic location regarding base liquidation timelines and costs before risk adjustments and adjustments for each economic stress scenarios we run. Base timelines and costs are derived from industry averages and risk-adjusted.

Quality of Loan Underwriting

Depending on the assignment, Berkshire may perform a detailed loan file review and order BPOs or appraisals for selected loans in a given client’s portfolios. We usually conduct extensive interviews with client personnel responsible for the retail and wholesale lending operations. We review underwriting standards and product matrices provided to us. Based on the results of these interviews and document reviews, we draw conclusions and make assumptions used in our modeling about the adequacy of origination guidelines, and procedures and controls in place.

Capability of Servicing Operations

Berkshire may visit the client’s servicing operations to perform a detailed analysis of systems, procedures, controls, management and tracking of servicing activities. While there, we conduct extensive interviews with collections and other servicing personnel and review servicing reports provided by the client. Based on our interviews and review of the documents, we draw conclusions and make assumptions used in our modeling about the adequacy and effectiveness of servicing capabilities.

Transparency

Assumptions used for modeling are explicit and table based. Major assumptions are shown as part of the output. Berkshire’s Model can risk-adjust performance curves based on any field for which data is collected. It provides both summary and loan level output. Stratification reports are produced each time loans are priced with pricing shown for each stratum. This allows for a top level reasonableness check.

Loan level pricing and whole loan analysis is performed by an analyst and reviewed by the senior analyst prior to being released to a client. A Berkshire principal reviews exceptions and outlier situations.

Reports

Berkshire produces both standard and customized reports. Our basic reporting package contains the following items:

- Pool Stratification Report

- Summary Valuation Report

- Loan Level Valuation Report

- Pool Level Monthly Cash Flows Report

- Pool Level Monthly Delinquencies Report (for all buckets)

- Pool Level Collateral Owner Financial Statements[4]

- Pool Level MSR Owner Financial Statements

Customized reports are generally provided.

MSR-Focused Elements of Valuation

Berkshire models servicing cash flows simultaneous with collateral cash flows. Servicing revenue, expenses, advances and reimbursements are a function of the performance metrics of the loans. The servicing module within the Berkshire Model also pulls in factors not impacting the collateral cash flows.

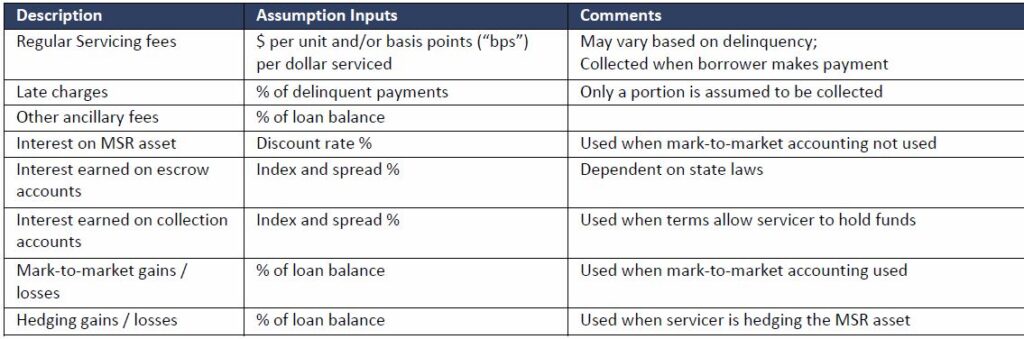

Loans serviced for others are subject to terms of servicing agreements. Key terms (dates, fee amounts, etc.) are loaded into the Berkshire Model assumption tables. The following table lists many of these servicing-related assumptions:

Revenues

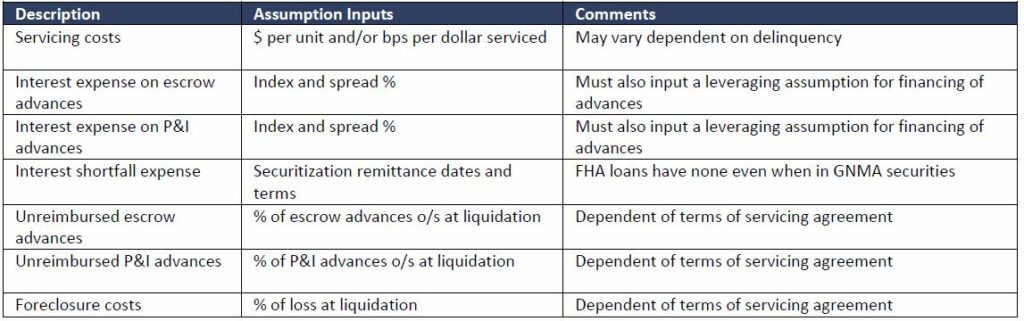

Expenses

Servicing fees accrued and collected are projected based on fee rates [basis points times unpaid principal balance (“UPB”), or dollar amount per unit based on delinquency], and whether fees can be collected if a borrower payment is not collected. Late charges are projected based on fee rates, payment timing assumptions and percentage of such fees assumed to be collected, waived or lost. Ancillary fees are programmed to reflect servicer norms.

Servicing Modeling Assumptions

Assumptions for day patterns of collections within each month, as well as client-specific monthly dates for required distributions to trusts and investors, are also used to project cash available to meet the distribution requirements. By comparing the timing of collections to the timing of distribution obligations, the model determines the magnitude of required servicing advances or whether the servicer can borrow excess funds from the trust to meet advance obligations. This calculation takes into account prepayment interest shortfall obligations of the servicer.

Using U.S. state or Caribbean Island specific assumptions, model tables include property tax rates and homeowner insurance rates to project escrow balances for loans on which escrow accounts are maintained. This allows for calculation of interest earnings on escrow accounts, as well as interest expense for amounts required to be paid to borrowers as required by a specific region.

Servicing costs are highly dependent on levels of delinquency, the unit cost to service by level of delinquency, and the geographic distribution of loans. The model captures all of these elements to project the timing and magnitude of servicing costs.

Some servicing contracts set out provisions preventing the servicer from recovering advanced costs under certain circumstances. The model allows for entering assumptions to capture these provisions. Also, some servicing contracts include loan loss recourse obligations of the servicer. The model can capture and allocate losses to the servicer when appropriate.

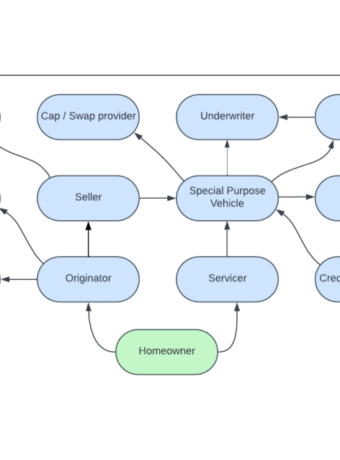

Transaction Support and Management

Berkshire provides a variety of transaction support and management services. A summary listing of services the firm performs are as follows:

- Assisting with development of new loan origination underwriting parameters, including base product characteristics, coupons, buy-ups and buy-downs, and other factors impacting performance and returns.

- Evaluating and pricing pools of loans involved in whole loan transactions, including:

- Examining program and underwriting guidelines under which loans were created;

- Tape cracking, data cleansing, and data analysis;

- Loan level, risk-adjusted pricing;

- Loan file due diligence.

- Participating in negotiation and drafting of purchase and sale, servicing, and securitization documents.

- Evaluating securitization clean-up calls for likelihood of successful auctions, preparing for and managing each auction process; soliciting and interacting with potential buyers, participating in negotiation and drafting deal documents, oversight of loan file due diligence.

- Assisting firms in securitizing loans:

- Providing loan acquisition transaction support (pool identification, evaluation, pricing, due diligence, document preparation, closing);

- Securitization transaction support:

- Pool selection;

- Running loan and bond cash flows;

- Assisting in drafting and negotiating deal documents and accompanying schedules;

- Post transaction surveillance.

- Evaluating and valuing residential, consumer, and commercial loans and related assets and loss reserves in support of company acquisition transactions.

Berkshire Group principals have been directly involved in non-prime and prime whole loan, servicing rights, and securitization transactions dating back to the 1980s. Our prime focus is on non-prime assets, though we are substantially involved with prime assets as well. We maintain massive loan performance databases which we use as part of the support for the assumptions that go into our analysis and pricing.

Database and Hosting Platform

Berkshire maintains massive databases tracking monthly performance of approximately 250+ million active and resolved residential mortgages, 20+ million of which are non-agency (Conventional, Jumbo, HELOC, Alt-A and Subprime). From examination of this data, the Company builds performance curves, risk adjustment factors, foreclosure and liquidation timelines, and other analytics variables. Berkshire Group examines performance of loans with common and differing characteristics across multiple economic stress scenarios in developing its curves and factors. The Company uses derived curves and factors in its models and in support of many of the advisory services it offers.

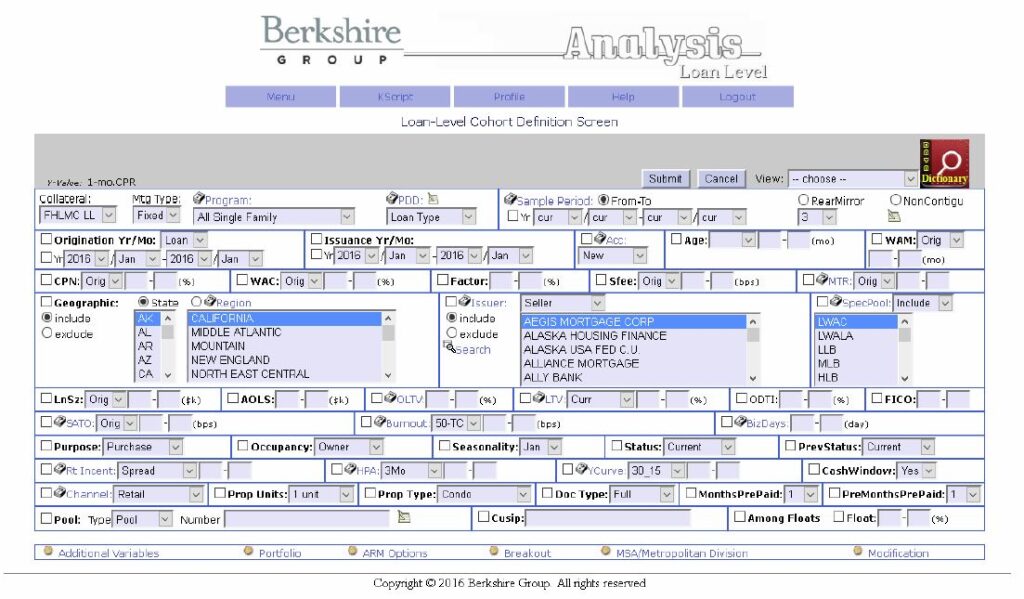

Through the Company’s BGVAL hosting platform, Berkshire makes available to its clients access to the data and extensive tools for analyzing information and trends in the data.

With simplified graphical user interface tools, clients can build queries to mine the data and find answers to performance questions for loans in one securitization or across thousands of securitizations.

Due Diligence Services

Berkshire provides mortgage loan file due diligence, operations due diligence, and compliance reviews.[5] The company maintains an operations center in Lake Zurich, IL, which houses underwriters and mortgage compliance experts. It also distributes its underwriting and document images systems to underwriters throughout the country for remote processing of loans under review.

The Company’s underwriters review new loans in support of transactions, and aged loan files on a forensic basis in support of investigations and dispute resolutions. Loans are reviewed for conformity with underwriting guidelines and correspondent program guidelines, and to evaluate representation and warranty claims for repurchase or make whole payments.

Berkshire personnel also perform servicer and originator operational reviews, examining the organizational structure, processes and controls, procedures, financial strength and other factors of the target company. These reviews are generally performed on behalf of either the company being reviewed for its own benefit, or for one of their counterparties seeking to gain confidence in their capabilities.

Berkshire compliance experts also assist clients in developing processes and procedures, and in preparing manuals describing procedures for processing origination and servicing transactions. Berkshire compliance personnel assist clients in preparing for CFPB audits and SEC anti-money laundering reviews.

By leveraging the Company’s proprietary technology, dedicated loan review center, and the depth of experience of underwriting, compliance, analytics, and operational review staff, Berkshire implements customized diligence solutions for our clients.

Berkshire’s menu of due diligence and compliance services includes:

Loan Review and Due diligence

- Loan File Review of Newly Originated and Seasoned Loans

- Repurchase Review and Analysis

- Data Integrity and Bookmarking

- Forensic Review Services

- Property Valuation Review

- Fraud Audit Services

- Expert Witness Services

- Customized Due Diligence Services

Compliance and Internal Audit Services

- Regulatory Compliance

- CFPB Examination Review

- Anti-Money Laundering Program for Non-Bank Lenders

Operational Risk Management

- Operational Reviews

- Counterparty Reviews

- Lender Practice and Dispute Resolution

Business Process Improvements

- Policies and Procedures

- Development

- Review

- Process Re-engineering

[1] More information is available at the website: www.bglp.com.

[2] Related assets include mortgage-backed securities (“MBS”), asset-backed securities (“ABS”), mortgage servicing rights (“MSRs”), and derivative securities such as swaps and caps.

[3] The 260+ million loans includes 20+ million subprime and alt-A mortgage loans (2.5+ million active) , and 235+ million agency mortgage loans (42+ million active) in the U.S. and the Caribbean, which are contained within tens of thousands of securitization transactions.

[4] Loan collateral cash flows can be run through any proposed financing structure, or combination of financing structures (on or off balance sheet) desired. The model generates monthly cash flows and balances are for all asset, liability, equity, revenue and expense accounts, based on user-input debt and capital structures, and related costs. This allows projection of complete monthly financial statements for each loan and any desired roll-up, and can simultaneously and separately project the collateral and servicing cash flow components of each loan.

[5] In the mortgage banking industry, underwriting and operational guides are written and enforced across a spectrum of completeness and stringency. Human and software systems implementing those guides are not universally trained or programmed for consistency. Berkshire analysts help clients root out nuances and system failures that cost money from delinquencies, fraud, lawsuits, enforcement actions and loss of reputation.