GSE Credit Risk Transfer (CRT) Product Discussion – Part One of Three

Berkshire Group maintains databases tracking monthly originations and performance of both agency and non-agency mortgage loans. We also track industry and market metrics, and observe mortgage loan performance in relation to these metrics. We use these observations and data internally for analysis, and to support assumptions used in our valuation models.

Berkshire tracks individual loans related to the STACR; CAS; ACIS and CIRT credit risk transfer (CRT) programs. We also maintain and model CRT program transaction structures, waterfalls and cash flows analytics.

The following discussion and charts were derived from our data platforms.

Part One – General Background on CRT

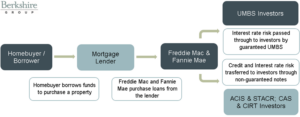

In 2012, the Federal Housing Finance Agency (FHFA) initiated development of Credit Risk Transfer notes (CRT Notes). In response to this FHFA initiative, Freddie Mac began issuing Structured Agency Credit Risk (STACR) notes, and Fannie Mae began issuing Connecticut Avenue Securities (CAS). The STACR and CAS notes are part of a Dodd-Frank Act mandate to reduce Fannie Mae and Freddie Mac credit risk exposure in the residential mortgage lending market.

In addition to CRT Notes, Freddie Mac and Fannie Mae (the GSEs) have introduced two CRT reinsurance programs. Freddie Mac issues Agency Credit Insurance Structure (ACIS) securities, and Fannie Mae issues Credit Insurance Risk Transfer (CIRT) securities. Under the ACIS and CIRT programs, the GSEs purchase credit reinsurance from private insurance companies.

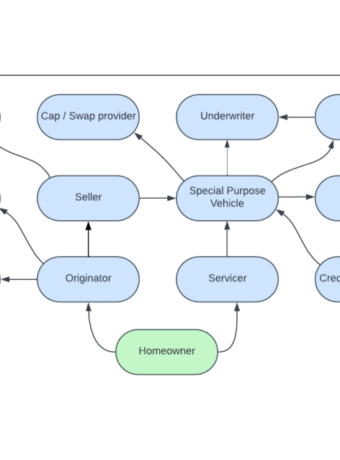

As with GSE Uniform Mortgage-Backed Securities (UMBS), CRT Notes pool thousands of different mortgages into a single security, and investors receive monthly payments based on the performance of the underlying loans. The loans are contained within multiple MBS; the CRT Notes are tied to “reference pools” tracking the performance of the actual loans across the multiple MBS. CRT Notes do not carry government guarantees, rather their purpose is to absorb part of the losses that the GSEs would otherwise incur, should the reference pool loans significantly underperform. CRT Note investors could lose much of their principal if a high number of reference pool loans default.

CRT Notes are structured in a similar way to lower tranches in other senior-subordinate tranche mortgage-backed securities. A portion of credit losses between a lower “attachment point” and upper “detachment point” (discussed later) are charged to the CRT notes.

The most-subordinate tranches collect more in interest while the deal is performing, but are first to absorb credit losses should they occur, followed by higher rated tranches, which collect less in monthly interest payments and are less likely to experience losses. The GSEs retain some credit risk exposure in each of the CRT Note tranches they issue. The GSEs use a portion of their G-Fees to pay the interest due to the CRT Note investors.

In ACIS and CIRT transactions, there are no lower tranche bond investors. Instead there are lower tranche bond reinsurers. In ACIS and CIRT transactions, reinsurers are paid a fixed monthly premium for providing the reinsurance coverage, absorbing a portion of the lower-tranche credit risk that the GSEs would otherwise retain and absorb. The insurance premiums, just like interest on CRT notes, come from the G-Fees that the GSEs collect on the underlying reference pools.

As with CRT note investors, ACIS and CIRT reinsurers absorb covered losses incurred between an attachment point and detachment point. To ensure sufficient claims paying ability, the GSEs require a collateral trust account be established, with a portion of potential covered losses contributed upfront by each reinsurance provider.

CRT investor and reinsurer credit risk exposure is a function of the attachment and detachment points in the CRT security. The attachment point is expressed as a percentage of the original unpaid principal balance of the reference collateral, indicating the level at which the investor begins to incur losses. The detachment point is the value at which the CRT investor would experience a full principal write down or the full limit of loss for the note insurer.

After the attachment point, CRT investors generally cover credit losses up to 3% to 4% of the total certificate amount, the amount varies by transaction. In extreme cases, where losses exceed the CRT detachment point, the losses beyond the detachment point would be retained by the GSEs. CRT structures are designed to cover severe stress scenarios, but not extreme ones.

CRT Note investors can trade securities in reaction to changes in market prices or as part of any other changes. Reinsurers provide coverage for credit risk from inception through expiry of the contract. Reinsurers take a longer-term view of the credit risk relative to the CRT Note investors.

As a consequence of the CRT programs, the GSEs realized lower average income, but also have less uncertainty and positive cash flows under severe stress scenarios.

CRT Program Transactions – Balance as of Issuance Year and as of November, 2022

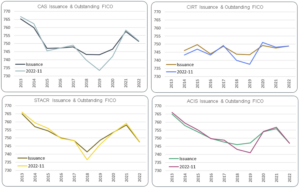

CRT Transactions – Original FICO Score as of Issuance year & as of November, 2022

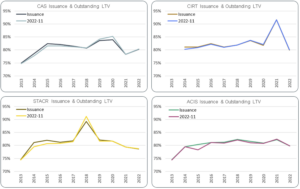

CRT Transactions – Original Loan to Value (LTV) Ratio as of Issuance & as of November, 2022

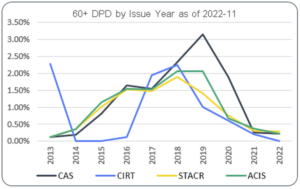

CRT Transactions – 60+ Days Past Due % by Issuance Year & as of November, 2022

In the second and third posts we’ll continue reviewing CRT Notes by focusing on the recent economic developments, the performance of loans and securities relevant to CRT Notes.

![]()

About The Berkshire Group

The Berkshire Group is a management consulting firm that works with lenders, servicers, securitizers, and others in the mortgage loan industry. We maintain proprietary databases and tools for pricing loans and MBS, performing loan file due diligence, evaluating portfolio performance, and scoring loans and MBS for likelihood of prepayment, delinquency, and default. Our clients use the tools for assisting in acquisitions, securitizations, portfolio management, evaluation of loss reserves and capital adequacy, loan buy-back claims, and litigation resolution.

Our agency and non-agency mortgage loan origination and performance databases allow us to monitor changes in loan origination characteristics, as well as analyze in detail the production and portfolios of specific lenders and servicers. Berkshire Group also tracks, analyzes, and incorporates within its pricing tools, historical home prices, unemployment statistics, interest rates, mortgage rates, property taxes, and property maintenance costs.