Over the last few weeks, market focus has been on the liquidity of banks, with some high profile names such as Signature Bank (SBNY), Silicon Valley Bank (SIVB), First Republic Bank (FRC), and others capturing the attention of regulators and investors alike. As a group, banks experienced stock market price declines, with a few having more worrisome financial profiles suffering significant declines.

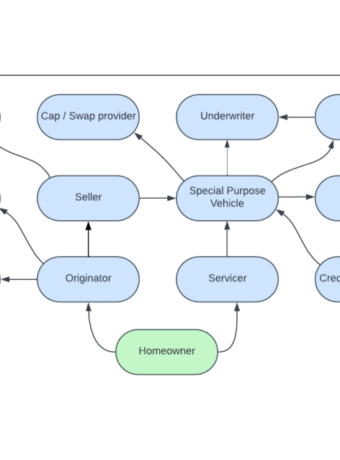

With all the attention on banks, we thought it would be interesting to see how some of the non-bank lender stocks were faring. Non-banks do not share the funding and liquidity advantages that banks have from core deposits and access to overnight borrowing. Non-banks are more dependent on warehouse lines and sales of loans into securitizations.

We guessed that non-bank lender stock prices were likely a leading indicator for bank stock prices, as warehouse line costs and securitization pricing changed more rapidly than rates banks paid on deposits. Indeed, we observed that to be the case, especially for non-banks which only recently went public (in the last four years).

We have included in this article charts showing stock prices superimposed on mortgage origination volume. We have also included other interesting charts showing earnings, and changes in portfolio composition metrics. The charts cover the last four years. This is a time-frame during which many of the non-bank lenders went public. We used loan-level data taken from Berkshire Group’s mortgage performance data platform, and share price and earnings data gathered from market sources.

We added comparable charts for a few banks to provide some basis for comparison. Please let us know if you would like to see information about other specific entities.

Non-Bank Lender Share Prices, Earnings, Origination Volumes and Portfolio Composition Trends

Post-2018-IPO -> Non-Bank Lenders

Most of the largest lenders selling loans into Fannie Mae and Freddie Mac’s UnIform Mortgage Backed Securities (UMBS) and/or GNMA securities went public in the 2020-21 timeframe, when mortgage rates were at or near historic lows. The low-rate environment contributed to a mortgage refinancing cycle, as did borrower needs for liquidity due to a less-certain economic environment. At this time, too, many new home-buyers entered the market, deciding, perhaps, that they needed additional space from which to work from home. $4.9 trillion of government stimulus helped to fuel home prices higher as well. Together, these factors contributed to a robust mortgage lending environment, and many non-bank lenders decided the time was right to take their companies public.

As you will see in the charts that we have included below:

- Refinancing activity peaked at the point rates reached their lowest levels;

- Strong demand for homes, coupled with vast stimulus liquidity, contributed to rapid home value increases;

- Rapidly rising home values translated into lower loan-to-value (LTV) ratios for refinancing borrowers;

- Some of the most-qualified borrowers refinanced at the lowest rate levels, with higher average credit scores and and lower average debt-to-income (DTI) ratios showing up in the data.

- The refinance wave ended in 2022:

- The Federal Open Market Committee (FOMC) began increasing the Federal Funds Rate in March, 2022;

- Mortgage rates quickly increased in lock-step;

- With increasing mortgage rates, the refinance volumes decreased, as did overall mortgage origination volumes;

- In the higher rate environment:

- The mix of mortgage originations dramatically changed from “mostly refinances” to “mostly home purchases”;

- Borrower taking the purchase money loans had lower credit scores on average;

- As opposed to refinances, in purchase transactions, the borrowers could not take advantage of increased home values:

-

- Instead, the buyers had to come up with down payments on higher-priced homes;

- Lacking sufficient funds, many borrowers opted for loan programs requiring less than 20% down payments;

- LTVs on the purchase money loans trended higher;

- This resulted in loans with LTVs greater than 80%;

-

- The share of loans with Mortgage Insurance (MI) increased, as a necessary condition for the loans to be sold into UMBS;

- The share of first-time home buyers increased, and so did average DTI ratios.

Lender revenues are largely driven by mortgage origination volumes. The lender benefits from origination fees and loan sale premium payments. In the charts below, you will see that a decline in origination volumes generally coincides with lender share price declines.

United Wholesale Mortgage (UWM) is the largest wholesale lender in the US, originating most of its volume through the broker channel. UWM Holdings Corporation (UWMC) went public on January 22, 2020.

Rocket Mortgage is the largest retail mortgage lender in the country. Previously known as Quicken Loans, the company was renamed in May, 2021. Rocket Companies (RKT) went public on August 8, 2020. The lender’s origination process focuses on its online-lending platform, which differentiates Rocket from more-traditional mortgage lenders.

The wholesale lender, Homepoint, is part of Home Point Capital Inc., which in turn, is backed by private equity firm, Stone Point Capital. Home Point Capital (HMPT) went public on January 29, 2021. In 2022, Homepoint sold certain of its delegated correspondent channel assets to Planet Home Lending, LLC.

LoanDepot is another retail lender focused on serving its clients using a proprietary online platform. The lender is in the process of migrating some of its back-end operations to Black Knight’s cloud-based loan origination system. LoanDepot, Inc. (LDI) went public on February 11, 2021.

Guild Mortgage Company is a subsidiary of Guild Holding Company. It has operated as an independent mortgage lender for more than 60 years. Over the last few months, Guild acquired three experienced lenders – Inlanta Mortgage, Legacy Mortgage, and Cherry Creek Mortgage. Guild Holding Company (GHLD) went public on October 22, 2020.

Finance of America covers multiple market segments. It provides agency, non-agency, reverse, and commercial real estate loans. Finance of America Companies Inc. (FOA) went public on April 1, 2021. In 2023, Finance of America Reverse, part of Finance of America Companies Inc., introduced HomeSafe Second, a unique junior lien reverse home equity mortgage as an alternative to cash-out refinancing and home equity line of credit (HELOC) products. In 2022, Finance of America Companies announced that it would acquire American Advisors Group, a reverse mortgage lender.

Pre-2019-IPO -> Non-Bank Lenders

Rithm Capital Corp. was established in 2011. Up until August, 2022, it was known as New Residential Investment Corp. Rithm Capital Corp. (RITM) went public on May 15, 2013. The company has acquired multiple lenders over the years, including Genesis Capital, Newrez LLC (aka New Penn Financial, LLC), and Caliber Home Loans.

PennyMac Financial Services is one of the county’s largest non-bank originators and mortgage servicers. The company is the largest non-bank correspondent-channel loan investor. Over the last year, PennyMac was the largest originator of Ginnie Mae guaranteed loans, issuing more than 12% of the total Ginnie Mae-guaranteed loans. PennyMac (PFSI) went public in May, 2013. The company was established (in 2008) by a former executive of Countrywide Financial.

Impac Mortgage Holdings, Inc. (IMH) was established and has been publicly traded company for more than 25 years. The company’s share price did not recover after the 2007 economic downturn, and has struggled ever since. Over the last several months, as part of the company’s business review initiatives, it has significantly reduced its office space, has chosen to move away from retail consumer direct lending into a mortgage broker fulfillment model, and has become a third-party originator.

Ocwen Financial Corporation’s (OCN) primary focus is the servicing and acquisition of residential and commercial loans. Over the years, the company has made multiple MSR portfolio acquisitions, including servicing books from HomEq, Litton Loan Servicing, Saxon Mortgage Services, Aurora Bank (commercial servicing rights portfolio), Homeward Residential Holdings, Residential Capital, OneWest Bank FSB, and PHH Corporation.

Fannie Mae and Freddie Mac are federally-backed home mortgage companies. Neither of them originates or services its own mortgages, instead buying and guaranteeing mortgages originated and serviced by different lenders and servicers. To reduce their exposure to credit risk, Fannie Mae and Freddie Mac have started issuing Credit Risk Transfer (CRT) securities, where investors assume not only interest rate risk, but also a portion of the credit risk of the underlying mortgages. Since the 2008 economic downturn, Fannie Mae and Freddie Mac remain under conservatorship and government control. The entities are still owned by shareholders, but the government has the right to take ownership of about 80% of both entities.

Bank Lender Share Prices, Earnings, Origination Volumes and Portfolio Composition Trends

With exception of Flagstar, we did not select banks with large mortgage originations. If you would like to see others, let us know. Berkshire Group’s mortgage performance data platform contains loan level data on all banks selling mortgages into Fannie Mae, Freddie Mac, Ginnie Mae, and most private label mortgage backed and/or asset backed securities. In addition to origination metrics, the performance data platforms allows you to query across a wide variety of other loan performance metrics as well.

First Republic Bank opened its doors more than 35 years ago. Over the years, the bank has both acquired, and been acquired by, other entities. In 2007, Merril Lynch acquired the bank, and then later sold it to private investors. In 2010, for the second time, the bank went public on New York Stock Exchange. Following the sharp declines in bank stocks in the first weeks of March, 2023, a group of major US banks agreed to provide a $30 billion deposit infusion into First Republic Bank.

Flagstar Bank is one of the largest bank originators of residential mortgages. Near the end of 2022, Flagstar was acquired by New York Community Bank. Consequently, Flagstar Bancorp (FBC) is no longer publicly traded, but still operates as a separate bank. In mid-March, 2023, Flagstar agreed to buy Signature Bank’s deposits and certain loan portfolios.

Zions Bancorporation (ZION) has a long history. Its stock has been publicly traded for more than 50 years. The bank operates multiple affiliate community banks, located predominantly in western states. For the last few weeks, the bank has been closely monitored, as its share price decreased by more than 40%.