Recent Trends in Mortgage Industry

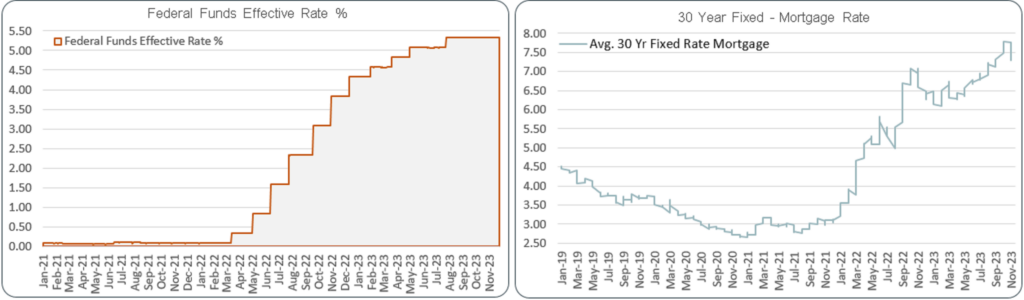

Over the 17 months ranging from March, 2022 to July, 2023, the Federal Reserve (Fed) raised the Fed Funds rates to their highest levels in more than fifteen years. In recent weeks, the markets have been betting that the Fed will hold interest rates unchanged for the near future, and then begin cutting rates in early 2024. Indeed, market bets appear to be justified, as the Federal Funds rate has remained unchanged for four months now.

Over the same 22 months period, residential mortgage loan rates followed a pattern similar to that of the Fed Funds rate. If the Fed does as the market expects and cuts early next year, mortgage rates will likely follow. If this happens, the mix of new mortgage origination volume will shift somewhat back towards refinances, as homeowners with loans taken out in the 2022-23 timeframe will find it beneficial to refinance.

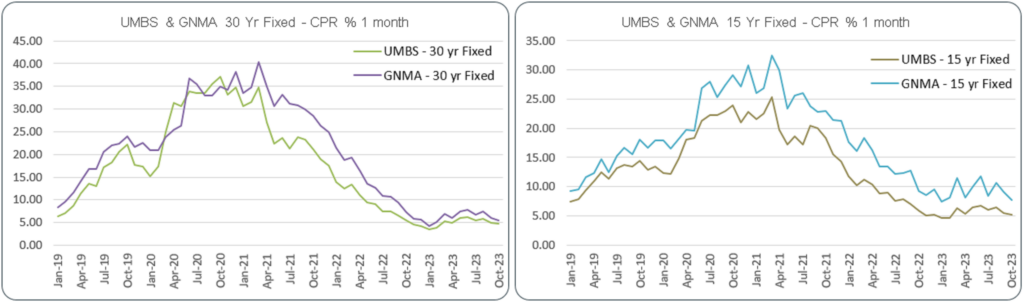

With the mortgage rates still at elevated levels, new loan volumes in Fannie Mae, Freddie and Ginnie Mae guaranteed securities have remained at depressed levels, dominated by purchase-money mortgage loan activity.

With the mortgage rates still at elevated levels, new loan volumes in Fannie Mae, Freddie and Ginnie Mae guaranteed securities have remained at depressed levels, dominated by purchase-money mortgage loan activity.

Composition of New Originations

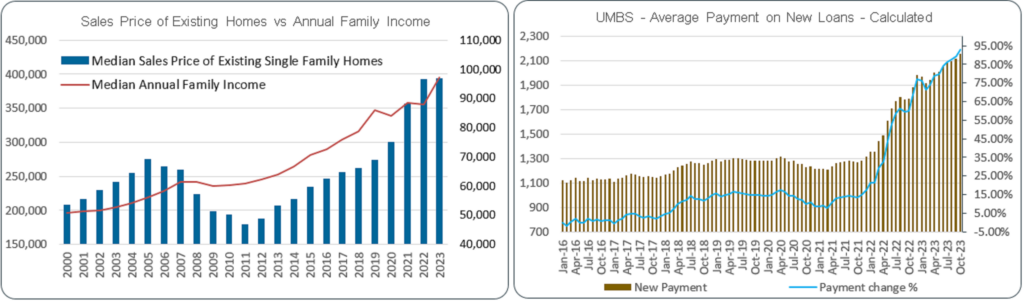

Existing home values have defied the expectations of many, and stayed high and even increased in certain markets. With increasing home values, the new mortgage balances are still trending upwards.

The “refinance” share of new originations remains below 20 %.

The “refinance” share of new originations remains below 20 %.

From refinances that are completed, the vast majority are cash-out transactions, where homeowners take out a portion of the built-up equity at the cost of larger loan balances at higher rates.

From refinances that are completed, the vast majority are cash-out transactions, where homeowners take out a portion of the built-up equity at the cost of larger loan balances at higher rates.

A large share of new mortgage loan volumes are attributable to first time homebuyer activity. In comparison to other homeowners, the first time homebuyers purchase real estate with smaller down-payment and take advantage of mortgage insurance. Although the share of first-time homebuyer loans with mortgage insurance in UMBS has declined in the last several months, still about 60% of 30-year loans for first time homebuyer purchases come with mortgage insurance.

A large share of new mortgage loan volumes are attributable to first time homebuyer activity. In comparison to other homeowners, the first time homebuyers purchase real estate with smaller down-payment and take advantage of mortgage insurance. Although the share of first-time homebuyer loans with mortgage insurance in UMBS has declined in the last several months, still about 60% of 30-year loans for first time homebuyer purchases come with mortgage insurance.

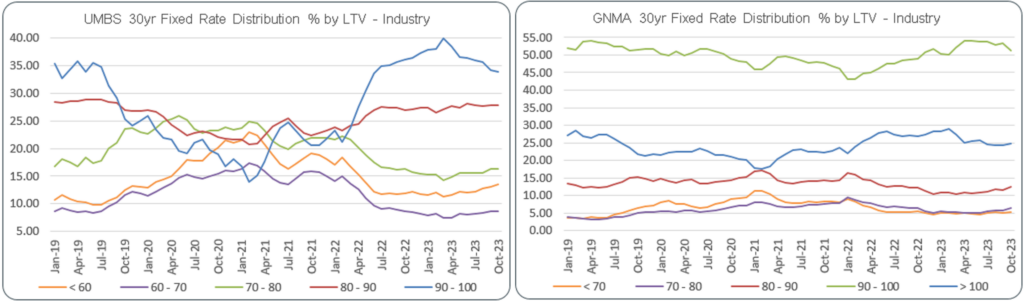

While Loan to Value (LTV) ratio dynamics have not changed much in originations of Ginnie Mae guaranteed loans, the opposite can be said about new loans in UMBS, where the share of LTVs < 80% have decreased and a considerable increase in the share of 90-100% LTV loans and a slight increase in the share of 80-90% LTV loans has occurred over 2022-23 timeframe.

While Loan to Value (LTV) ratio dynamics have not changed much in originations of Ginnie Mae guaranteed loans, the opposite can be said about new loans in UMBS, where the share of LTVs < 80% have decreased and a considerable increase in the share of 90-100% LTV loans and a slight increase in the share of 80-90% LTV loans has occurred over 2022-23 timeframe.

Burden of Monthly Payments

Burden of Monthly Payments

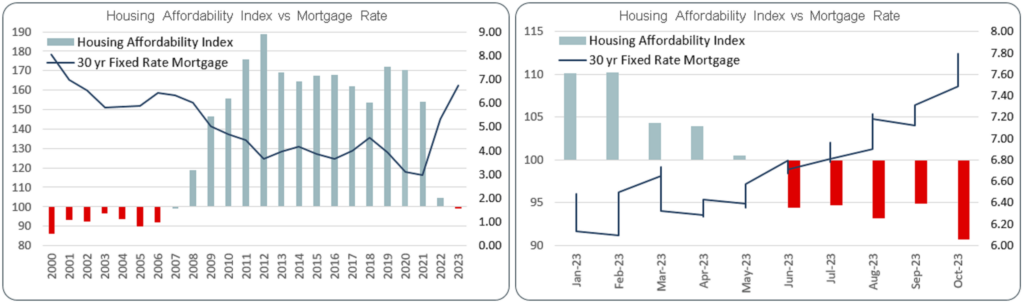

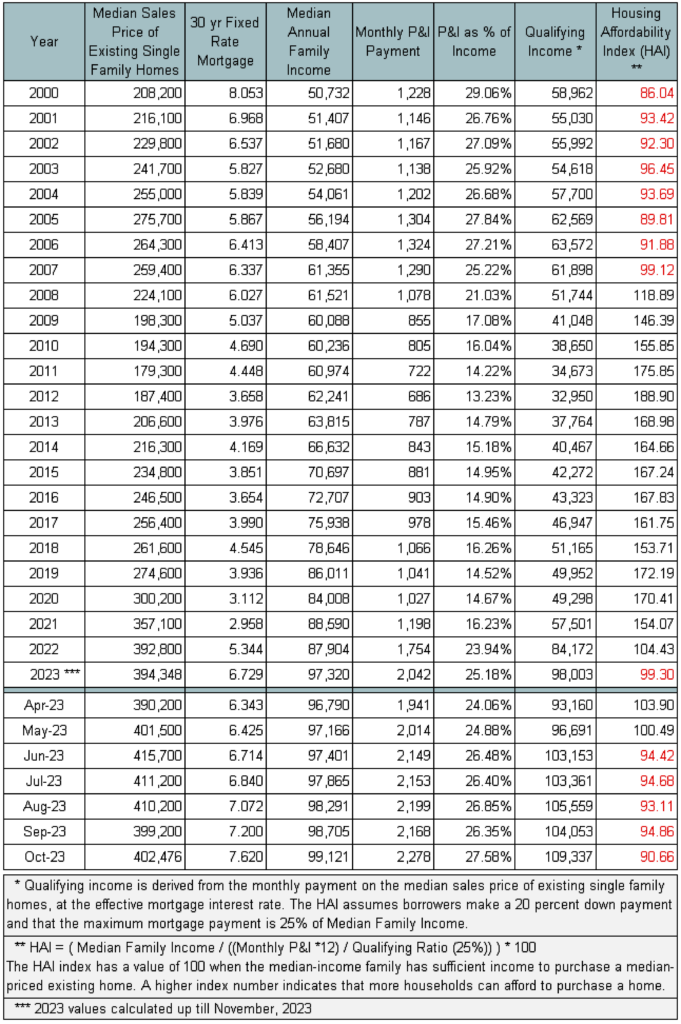

With the steep increase in mortgage rates, the principal and interest payments have almost doubled on newly originated 30-year term mortgages over the last two years.

A higher “housing affordability index” ratio indicates relatively more affordability. A ratio of 100 suggests that median family income is just sufficient to cover monthly principal and interest mortgage payments at market rates. When the ratio falls below 100, the typical household has less income than necessary to afford mortgage payments. The index calculations assume that a household makes a 20% down-payment towards the house, and only 25% of median income can be allocated to mortgage payments. Although on average the index is just below 100 for 2023, for the last 5 months it has been declining more below 100.

A higher “housing affordability index” ratio indicates relatively more affordability. A ratio of 100 suggests that median family income is just sufficient to cover monthly principal and interest mortgage payments at market rates. When the ratio falls below 100, the typical household has less income than necessary to afford mortgage payments. The index calculations assume that a household makes a 20% down-payment towards the house, and only 25% of median income can be allocated to mortgage payments. Although on average the index is just below 100 for 2023, for the last 5 months it has been declining more below 100.

About The Berkshire Group

The Berkshire Group is a management consulting firm that works with lenders, servicers, issuers, and others in the mortgage loan industry. We maintain proprietary databases and tools for pricing loans and MBS, performing loan file due diligence, evaluating portfolio performance, and scoring loans and MBS for likelihood of prepayment, delinquency, and default. Our clients use the tools for assisting in acquisitions, securitizations, portfolio management, evaluation of loss reserves and capital adequacy, loan buy-back claims, and litigation resolution.

Our agency and non-agency mortgage loan origination and performance databases allow us to monitor changes in loan origination characteristics, as well as analyze in detail the production and portfolios of specific lenders and servicers. Berkshire Group also tracks, analyzes, and incorporates within its pricing tools, historical home prices, unemployment statistics, interest rates, mortgage rates, property taxes, and property maintenance costs.