“All models are wrong, but some are useful.” — George E.P. Box

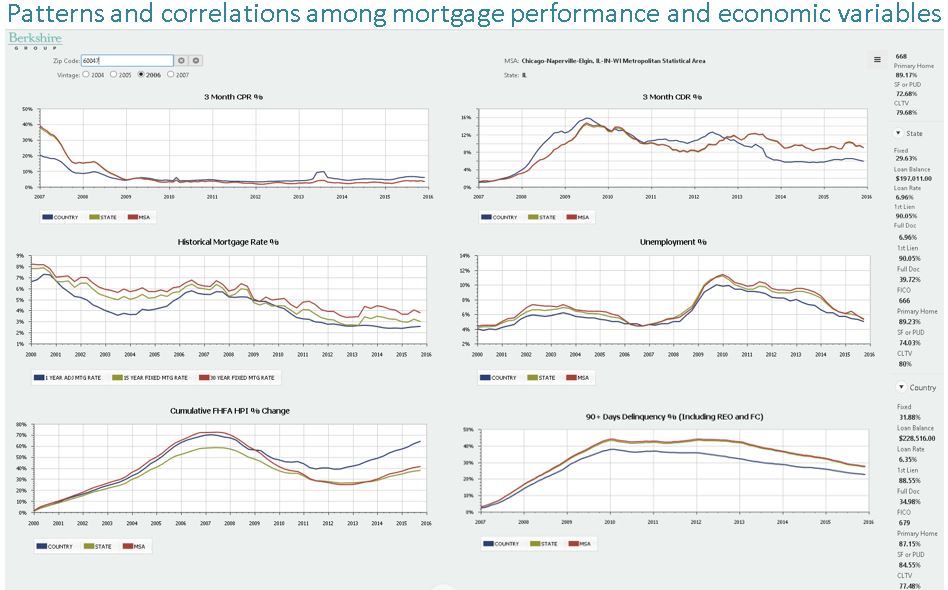

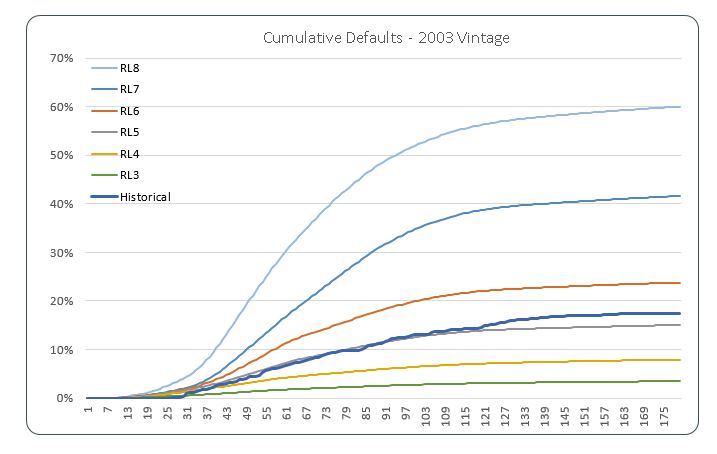

A primary service offered by Berkshire Group is predictive modeling of loan performance. This include loan balances, cash flows, delinquencies and losses. We maintain proprietary models used as part of our advisory services and are also adept at building custom models for our clients. A detailed write-up of our modeling system and processes can be found here.

Predictive modeling serves as the foundation for:

- Loan loss forecasting and loss reserve analysis

- Stress testing

- Loan pricing

- Servicing rights pricing

- MBS and ABS pricing

- Derivatives security pricing

- Capacity planning

Predictive modeling is a part of many of the other services that Berkshire Group provides, including:

- Transaction support services

- Litigation and dispute resolution

- Financial advisory services

Modeling Assumptions

Many of the assumptions used in our modeling are derived from our massive residential mortgage industry databases. We track monthly performance on roughly 44 million active residential mortgage loans, and historical monthly performance data on another 215 million residential mortgage loans no longer outstanding.

Other Asset Classes

Additionally, we maintain monthly performance data on other categories of consumer loans, including:

- Automobile loans

- Prime / Subprime

- New / Used

- Time-share loans

- Manufactured housing chattel loans

- Single-wides / Multi-wides / Tiny Homes

- New / Used

- In Community / On Private Land

- Other consumer loans

These loans have unique performance characteristics, owing to being either unsecured, or secured by assets more susceptible to depreciating value.

Macroeconomic Factors

Berkshire Group also tracks various macroeconomic factors correlated to or directly impacting borrower behavior and the performance and value of loans. All this so you can become more aware of opportunities to increase the return and reduce the number of loans in the portfolio that are charged off.

Berkshire transforms data into meaningful insight that allows you to make informed decisions about your investments. We help our clients to analyze the past, understand the present, and predict the future by providing reliable predictive models.